Dependent Care Fsa Limits 2025 Irs

Dependent Care Fsa Limits 2025 Irs. The dependent care fsa limits are shown in the table below, based on filing status. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

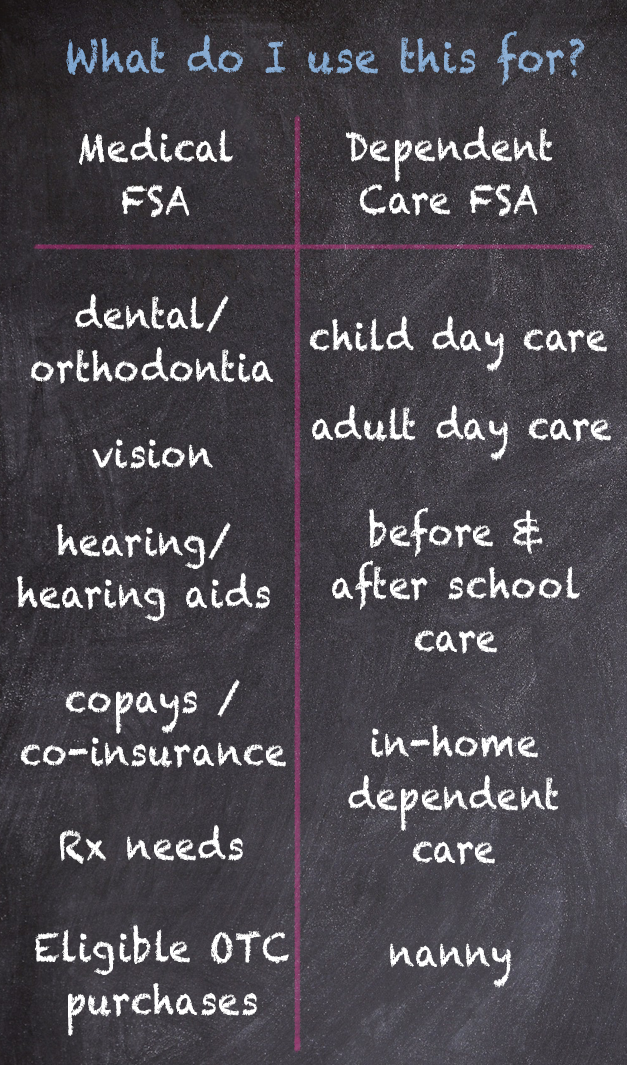

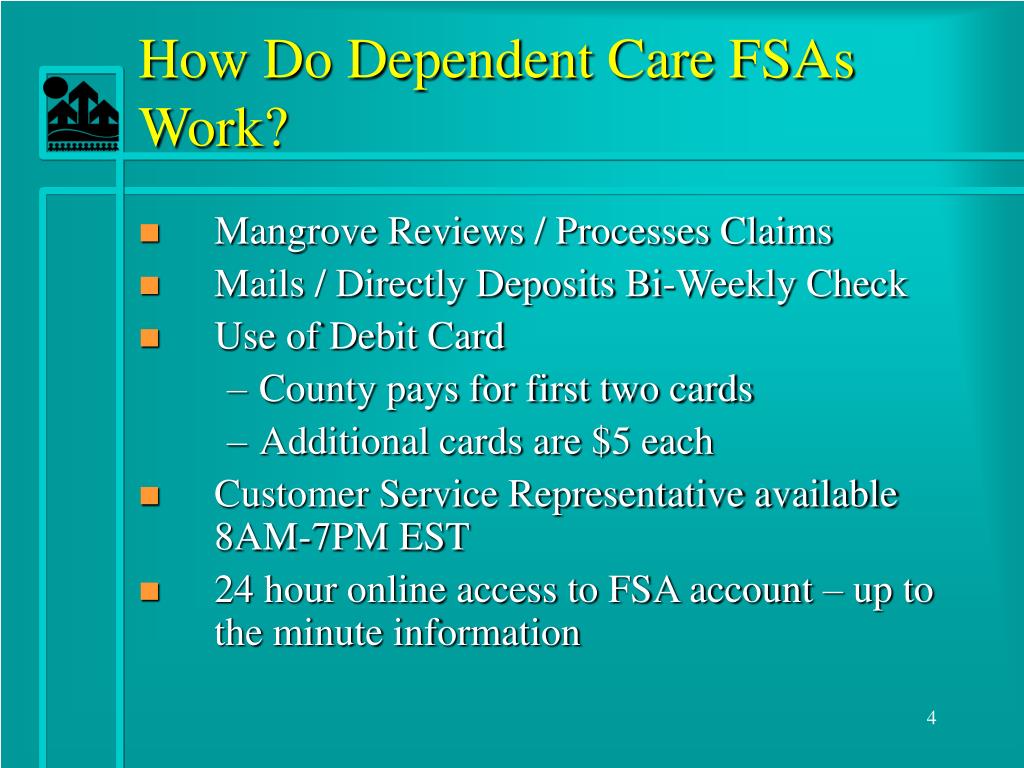

A dependent care flexible spending account can help you save on caregiving expenses, but not everyone is eligible. What are the 2025 allowable amounts for the dependent care assistance program (dcap)?

Fsa Limits 2025 Dependent Care Rania Catarina, What is the new fsa contribution limit in 2025?

2025 Dependent Care Fsa Limits Aileen Wendye, Dcap, also known as a dependent care flexible spending account (dcfsa),.

Dependent Care Fsa Limit 2025 Over 65 Kalie Marilin, The limits for 2025 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for.

Dependent Care Fsa Limit 2025 Irs Suzi Zonnya, Generally joint filers have double the limit of single or separate filers.

2025 Dependent Care Fsa Limits Irs Nona Thalia, The irs sets dependent care fsa contribution limits for each year.

Annual Dependent Care Fsa Limit 2025 Over 65 Tessy Germaine, The consolidated appropriations act, 2025 (caa), signed into law at the end of 2025, allows employers that sponsor health or dependent care fsas to permit.

2025 Dependent Care Fsa Limits Irs Ketty Merilee, The dependent care fsa limits are shown in the table below, based on filing status.

Dependent Care Fsa Contribution Limit 2025 Olympics Willy Julietta, 5 to learn about the specific eligibility.

Fsa 2025 Contribution Limits Arlyn Caitrin, On november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.