Irs Section 179 Vehicles 2025

Irs Section 179 Vehicles 2025. That topic concerns using the section 179 tax deduction for suvs and passenger vehicles exceeding 6,000 lbs. The section 179 tax deduction lets small businesses deduct the cost of qualifying equipment rather.

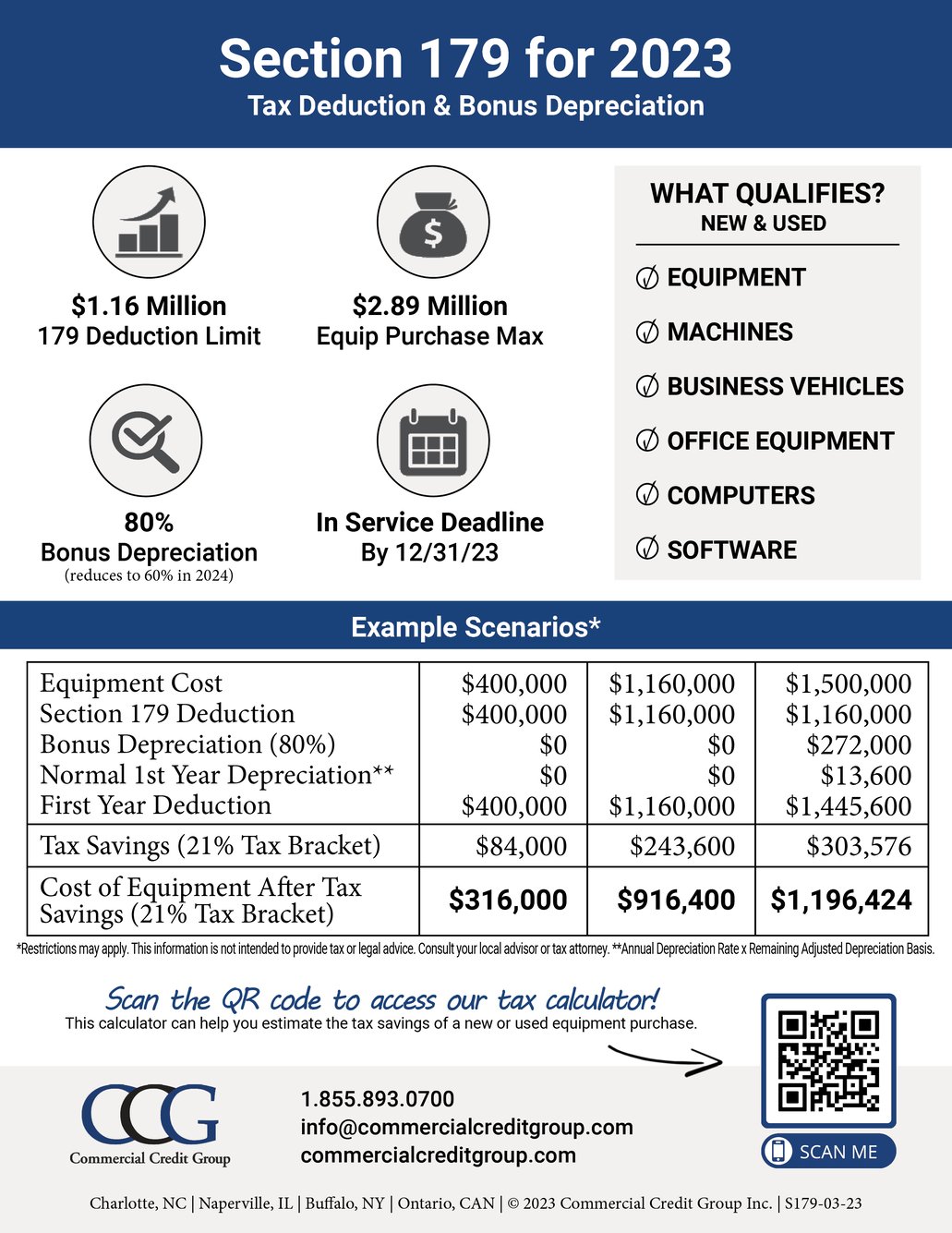

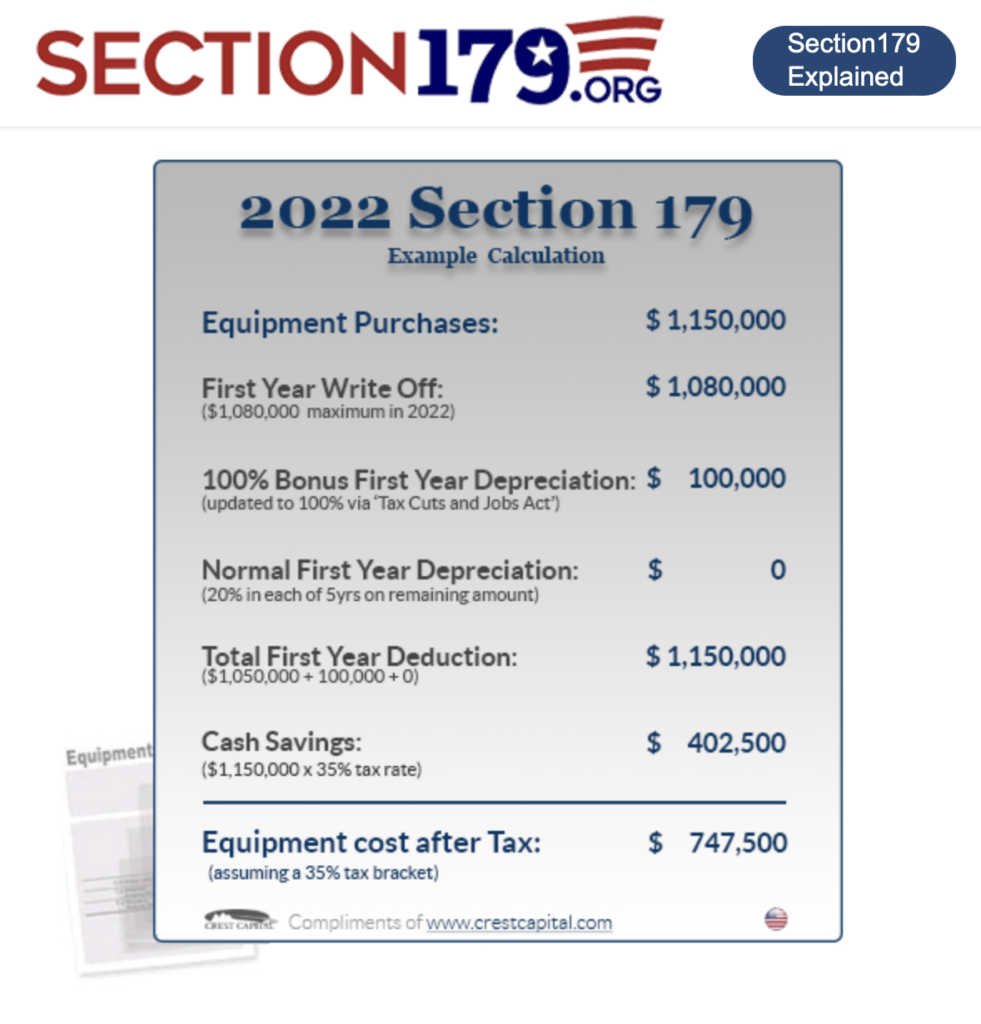

Under the 2025 version of section 179, businesses cannot deduct more than $1,220,000 in assets. A beginner’s guide to section 179 deductions (2025) the ascent.

8+ Section 179 Deduction Vehicle List 2025 Everything You Need To, Use section 179 first to write off the full purchase price of eligible assets up to the limit. Getting you on the road to big tax deductions.

Section 179 All Roads Kubota Bel Air Maryland, Irs rules require most businesses to apply section 179 first. That topic concerns using the section 179 tax deduction for suvs and passenger vehicles exceeding 6,000 lbs.

Section 179 IRS FORM Explained… YouTube, That topic concerns using the section 179 tax deduction for suvs and passenger vehicles exceeding 6,000 lbs. Section 179 deduction dollar limits.

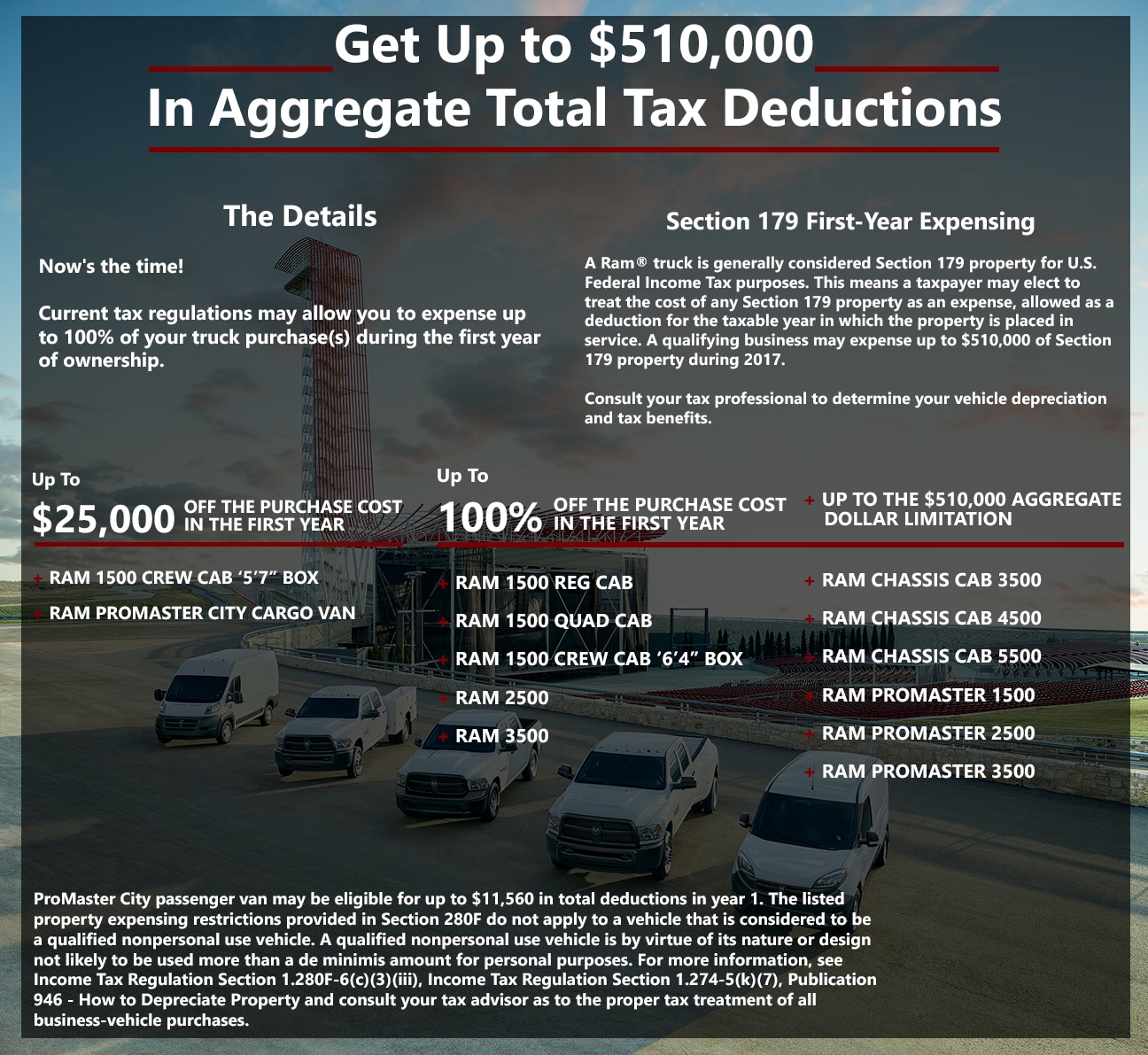

What Vehicles Are Eligible For Section 179? See Pickup Trucks & SUVs, This regulation has been very beneficial for small business. A guide to the section 179 deduction and equipment.

Section 179 IRS Tax Deduction Updated for 2025, Irs rules require most businesses to apply section 179 first. Combine section 179 with financing for significant savings.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, That topic concerns using the section 179 tax deduction for suvs and passenger vehicles exceeding 6,000 lbs. Irs rules require most businesses to apply section 179 first.

Section 179 Tax Benefit for Relocatable Storage Units Boxwell, Are you looking to purchase or finance a new or. Getting you on the road to big tax deductions.

Section 179 Deduction Vehicle VEHICLE UOI, Section 179 deduction dollar limits. What are some rules & considerations for section 179 vehicle deductions?

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, Did you purchase or finance a new or used vehicle for your small business? Paving your road to substantial tax deductions | infiniti of clarendon hills.

Section 179 Vehicle Tax Info Armory CDJRF of Albany, A guide to the section 179 deduction and equipment. Did you purchase or finance a new or used vehicle for your small business?

Eligible vehicles must exceed 6,000 gvwr and can include different car categories, like trucks, vans, and suvs.