Medicare Levy Surcharge Threshold 2025

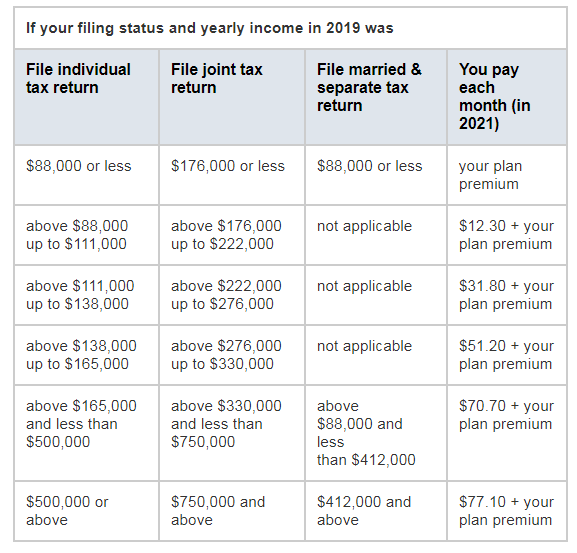

Medicare Levy Surcharge Threshold 2025. To avoid a hefty irmaa surcharge in the future, you may want to take steps to keep your modified adjusted gross income below the thresholds. Introduced with the treasury laws amendment (cost of living tax cuts) bill 2025, the bill amends the a new tax system (medicare levy surcharge—fringe.

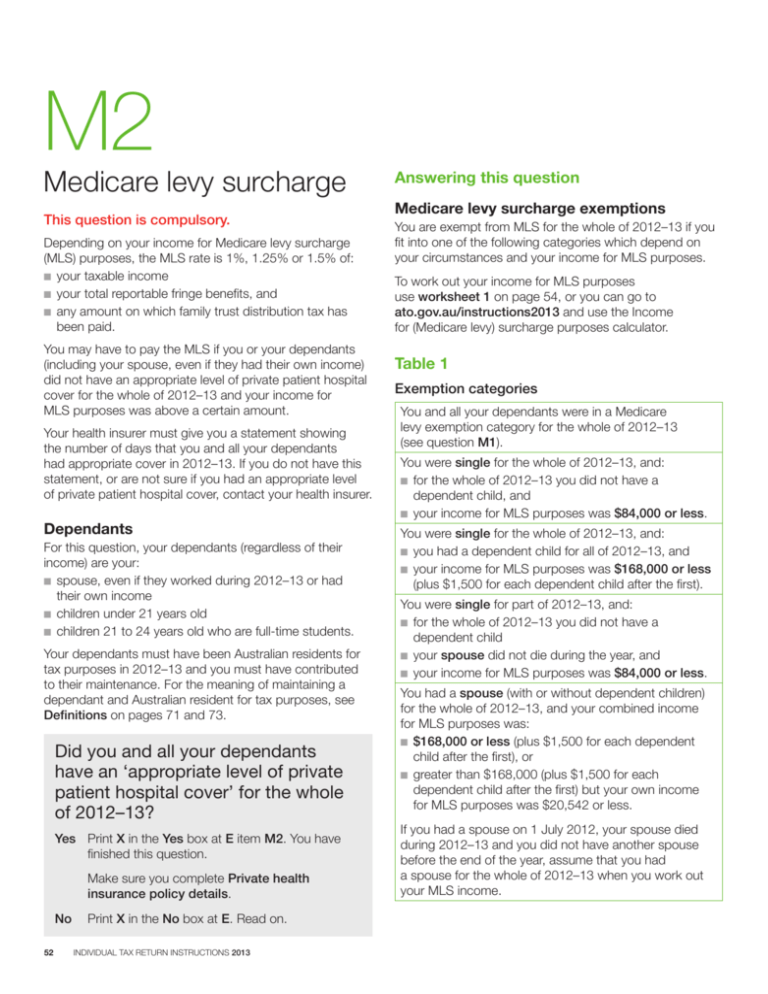

The medicare levy surcharge (mls) is an additional tax in australia that applies to individuals and families who earn above a certain income threshold and do not have.

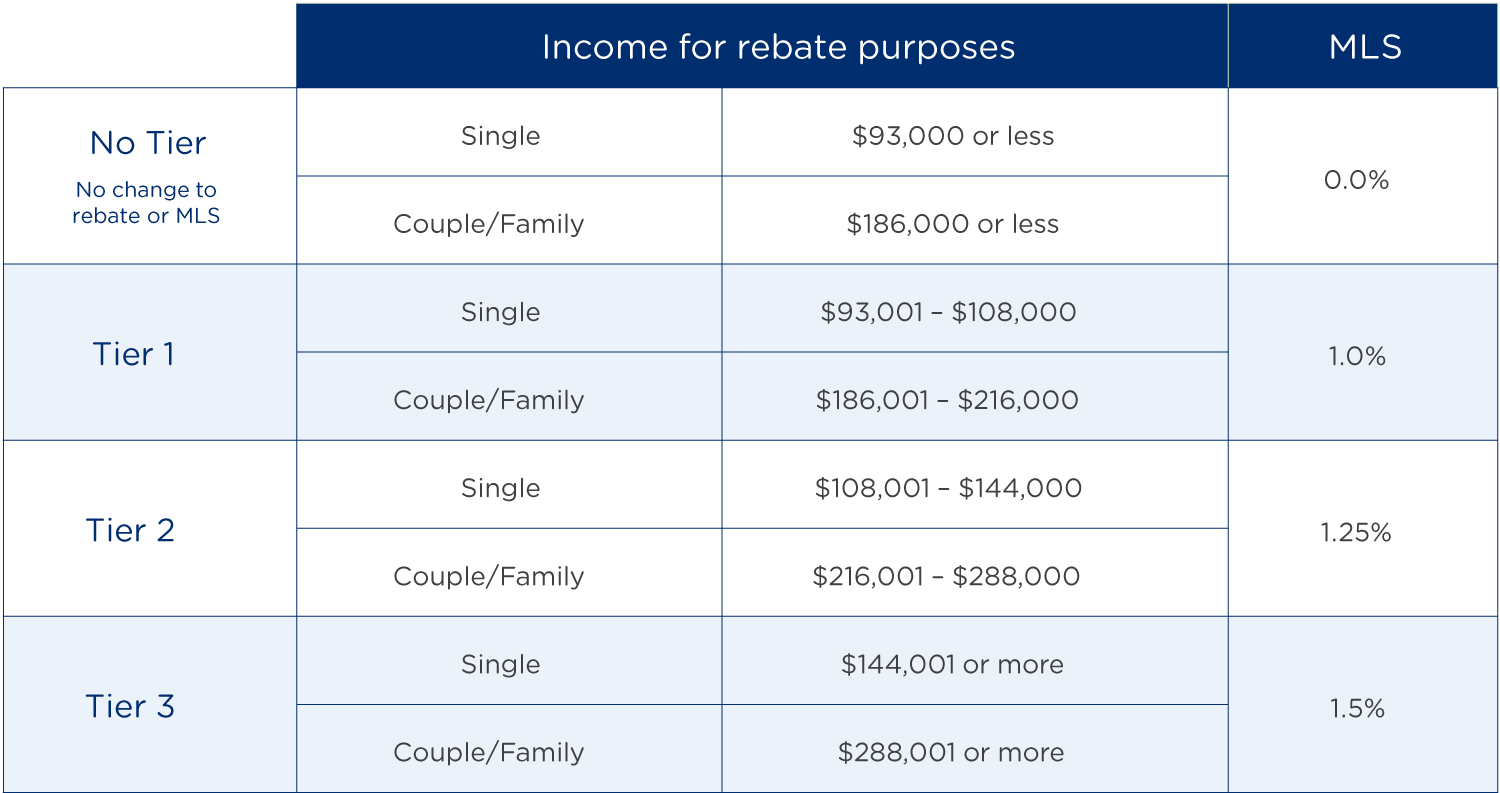

Medicare Levy Surcharge Navy Health, People who earn over $97,000 ($103,000 in 2025) and. The medicare levy surcharge is an additional tax of between 1% and 1.5%, depending on how much you earn.

Who Pays the Medicare Levy & Medicare Levy Surcharge?, People who earn over $97,000 ($103,000 in 2025) and. Find out when you have to pay the medicare levy surcharge and the income thresholds.

Explainer What is the Medicare Levy, Medicare Levy Surcharge and the, More people may find themselves exempt from the medicare levy surcharge come july 1. The full 1.5% is only applied to singles who earn more than $144k.

What Is The Threshold For Medicare Surcharge, It is in addition to the medicare levy of 2%, which is paid by most. More people may find themselves exempt from the medicare levy surcharge come july 1.

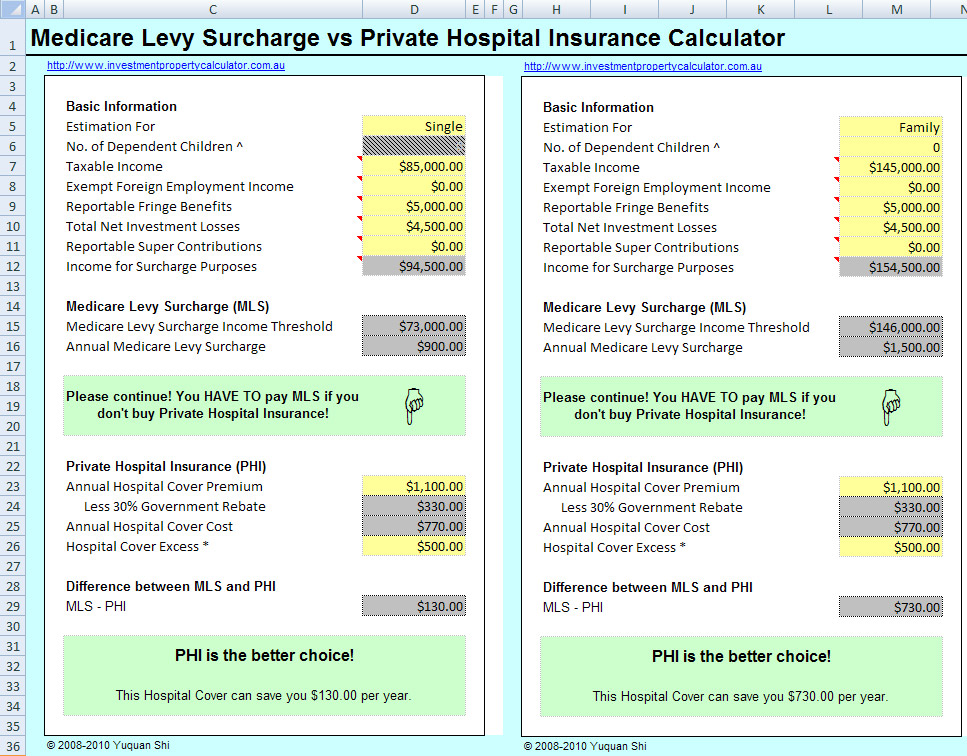

Medicare Levy Surcharge vs Private Insurance Calculator Free Download, To avoid a hefty irmaa surcharge in the future, you may want to take steps to keep your modified adjusted gross income below the thresholds. “we had a client who ended up.

Medicare Levy & Medicare Levy Surcharge Explained Rask Education, The medicare levy surcharge (mls) is calculated at a rate of 1%, 1.25% or 2% against your taxable income, total reportable fringe benefits and any amount on which family. To avoid a hefty irmaa surcharge in the future, you may want to take steps to keep your modified adjusted gross income below the thresholds.

Medicare levy surcharge, All australians contribute 1% of their income to support medicare and our public health system through a tax called the medicare levy. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.

How To Calculate Medicare Levy Surcharge, The surcharge is calculated at the rate of 1% to 1.5% of your income for medicare levy surcharge purposes. Introduced with the treasury laws amendment (cost of living tax cuts) bill 2025, the bill amends the a new tax system (medicare levy surcharge—fringe.

Medicare Levy Exemption For International Students, More people may find themselves exempt from the medicare levy surcharge come july 1. What is the medicare levy?

Federal Budget 202324 Personal tax Pitcher Partners, If you don’t have adequate hospital cover and earn. Find out when you have to pay the medicare levy surcharge and the income thresholds.