Nys Mileage Reimbursement 2025

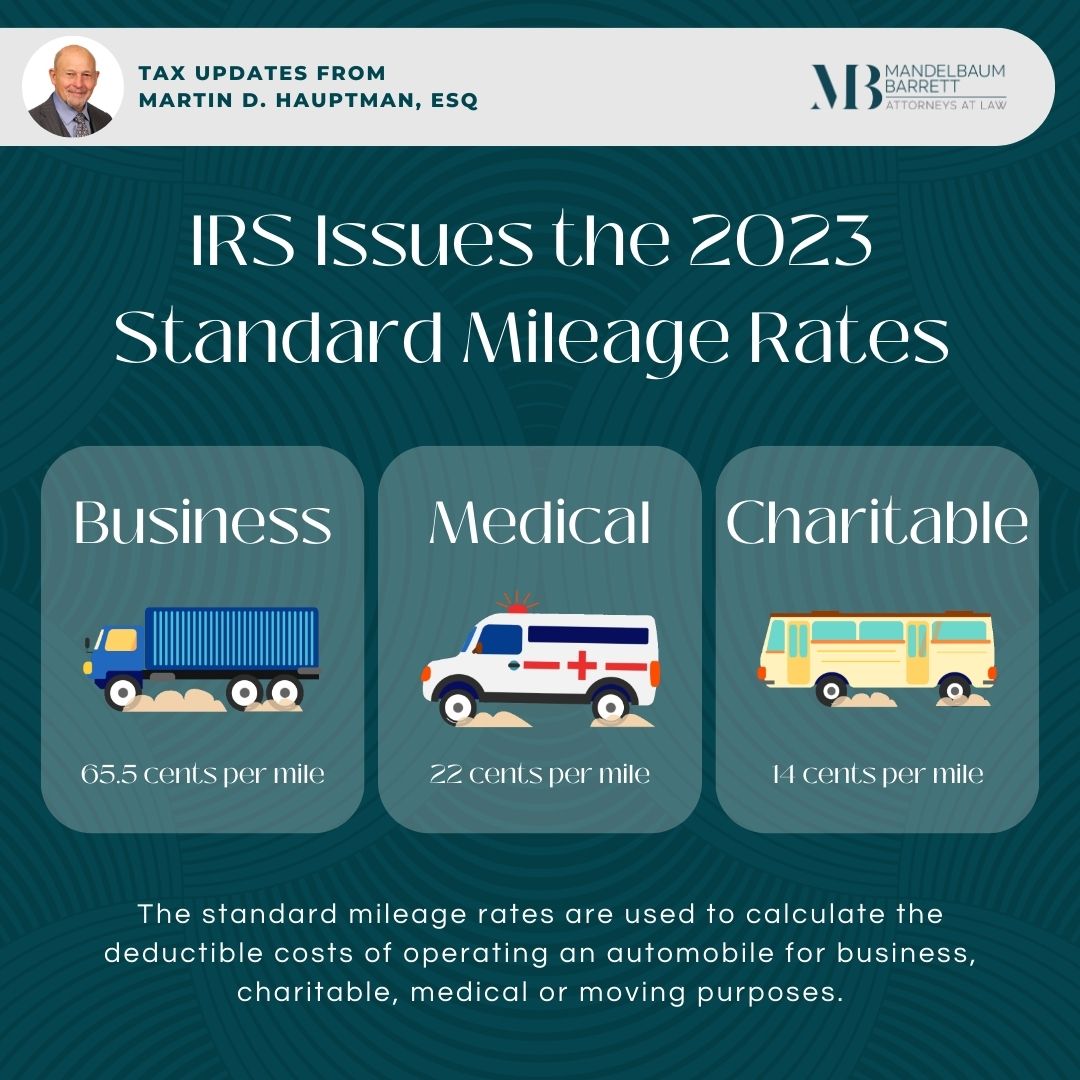

Nys Mileage Reimbursement 2025. The irs mileage rate determines how much money you can write off when. State employees in new york receive mileage reimbursement for travel incurred during official duties, aligned with irs and u.s general services administration (gsa) guidelines.

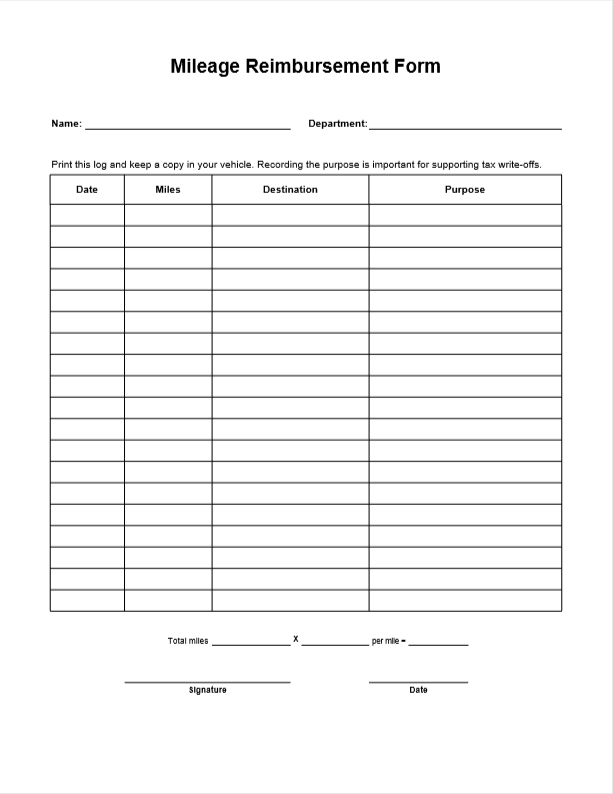

You can calculate mileage reimbursement in three simple steps: New york state (nys) reimburses its employees for meals and incidental.

Typical Mileage Reimbursement 2025 channa chelsey, Get insights on the irs mileage rate for 2025, predictions for increases, and tips to maximise.

2025 Irs Medical Mileage Reimbursement Rate William Short, The internal revenue service and the u.s.

Nys Mileage Reimbursement Rate 2025 Amelie Steffi, By adhering to this allowance, reimbursements for.

Revenue Canada Mileage Rate 2025 Samantha Marshall, When employees travel on state business, they are entitled to reimbursement for appropriate.

Canada Revenue Agency Mileage Rate 2025 Mora Tabbie, The purpose of this bulletin is to provide agencies with the 2025 calendar year.

2025 Nys Mileage Reimbursement Rate Ania Meridel, The current mileage reimbursement rate is $0.67 per mile.

.png)

Mileage Reimbursement 2025 Rate Of Return Phil Hamilton, The following lists the privately owned vehicle (pov) reimbursement rates for.

Ontario Government Mileage Rate 2025 Chloe Coleman, Xiii.4.d meals and incidental expenses breakdown;

August 2025 Calendar Wallpaper Embrace The Serenity Of Summer’s Last, By adhering to this allowance, reimbursements for.

Washington Mileage Reimbursement 2025 Irene Hardacre, Mileage reimbursement rates reimbursement rates for the use of your own.